HSBC

-

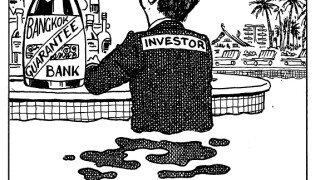

Thai hospitality company Minor International (Mint) used a guarantee from Bangkok Bank to issue a $300m bond this week. The deal structure, which echoes its 2018 debut bond, helped quell investor concerns about how Covid-19 has ravaged the borrower’s business. Morgan Davis reports.

-

Exxon Mobil, the US oil major, is due to establish a bond curve in euros for the first time, as it continues building up cash as the hydrocarbons industry is pummelled by the coronavirus pandemic.

-

MTU Aero Engines, the German aeroplane engine maker, has mandated for its debut senior euro benchmark bond. The marketing process shows signs of a defensive approach, as the aviation industry has been ravaged by the coronavirus pandemic.

-

NRW.Bank has mandated banks to arrange a series of virtual fixed income meetings as it looks to present its new social bond framework to investors ahead of a debut deal in the format.

-

An investor in United Laboratories International Holdings is selling a chunk of the firm’s shares for up to HK$790.6m ($102m), according to term sheet seen by GlobalCapital Asia.

-

Bank of China (BOC) raised $1bn from a dual tranche transaction at a negative premium on Thursday, after strong demand from its large syndicate group.

-

Haitong International Securities Group took advantage of a wide open market this week, raising $400m from a three year bond that priced inside fair value after heavy demand from the leads.

-

-

After making its highly anticipated debut in the international capital markets with a dollar benchmark this week, New Development Bank is looking to build a diversified funding programme, with euro and sterling-denominated bonds on the agenda for 2020. The new supranational has also set itself a target to become a triple-A rated issuer.

-

China Pacific Insurance (Group) Co became the second company to use the London-Shanghai Stock Connect scheme this week, listing Global Depository Receipts on London’s bourse. The deal could spur further London-bound issuance by Chinese firms, according to bankers in the UK and Asia. Jonathan Breen and Aidan Gregory report.

-

The Asian equity-linked bond market was flooded with deals on Wednesday as Far East Horizon, 3SBio and China Mengniu Dairy tapped investors for a combined $760m.

-

Hong Kong power generator Castle Peak Power Co took the nascent transition bond market a step further this week, selling a $350m deal that showed the potential for the sector. Morgan Davis reports.