Issues

-

Final US big bank to raise dollars after earnings

-

Relief at absence of full scale panic is clouding equity investors’ judgement

-

Trading lifted results at Barclays, Deutsche Bank and UBS but corporate finance goals will be harder

-

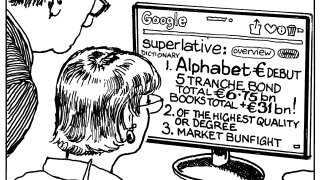

Google owner returns to dollar market for first time since 2020 for joint tightest 30 year spread ever

-

-

New issue premiums have risen, but even single-B rated issuers have priced deals

-

◆ $9bn raised in one go, peers inspired ◆ ‘Very efficient’ dual-tranche serves issuer well ◆ Tight Treasury spread but 'where the market trades’ is important

-

◆ Less frequent and smaller Europeans return after Iccrea reopening ◆ Latest sub-benchmark Austrian deal adds issuer diversity ◆ CCF meets annual funding need

-

Issuer was originally looking at a $1bn trade but found healthy demand

-

Fiserv and Visa print across the curve with more tipped to come

-

Two firms are vying to lead European investment banking pack

-

◆ Swap spread stability enables large $5bn trade ◆ Spread to US Treasuries gets squeezy ◆ Alternative executions considered but not needed