France

-

French financial institutions and corporates have been quick to jump at the funding opportunity offered by the offshore RMB bond market. Despite the line-up of success stories, however, French asset managers feel the market has some way to go before it comes of age.

-

Banque de France (BdF) is working with the financial sector to ready the market for the China International Payment System (CIPS) launch later this year, and has told GlobalRMB that the progress of the RMB means that inclusion in the IMF's SDR basket is simply a matter of "when and how".

-

Caisse Française de Financement Local proved the resilience of the covered bond market on Thursday by printing the first euro deal from a European issuer in three weeks. The defensive three year tenor was exactly what the market needed, according to rival bankers, and paves the way for more short-dated euro issuance.

-

It's been a good week for Europe's renminbi ambitions with the State Administration of Foreign Exchange (Safe) extending a Rmb50bn RMB qualified foreign institutional investor (RQFII) quota to Hungary, while China Construction Bank (CCB) listed its RQFII ETF on Paris’ Euronext.

-

Santander has issued European covered bonds from Spain, Portugal and UK but could soon be about to issue Obligations Foncières from a new French programme. However, the sub benchmark sized deals are likely to be placed with the ECB said bankers.

-

-

Compagnie de Financement Fonciere (CFF) has issued the first euro denominated three year conventional covered bond this year. Until recently, short dated covered bonds were trading with a negative yield in euros, something which made them impossible to sell. CFF’s trade has proved that this tenor is now open.

-

The long end of the French, Belgian and Dutch covered bond market is effectively closed for primary issuance because the rout in government bonds has made them too expensive. But bankers are hopeful that, with careful consideration of tenor and pricing, benchmark issuance should eventually return in shorter tenors, though probably not until June.

-

La Société de Financement Local (SFIL), which owns the French public sector covered bond issuer Caffil, has been given approval by the European Commission to originate and refinance large export credit guaranteed loans.

-

BNP Paribas made an opportunistic move to price the first 10 year covered bond in over a month on Tuesday via an intraday execution. Strong demand and a book that was twice covered allowed the issuer to increase the size of the deal to €750m from €500m and enabling pricing almost flat to BNP Paribas’ existing curve.

-

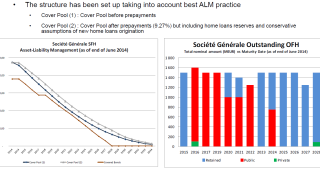

Société Générale issued and retained over €5bn of covered bonds, spread over eight deals with maturities between six and 15 years on Monday. The supply provides contingency backstop liquidity for the bank, and forms a normal part of its liquidity management activity.

-

Covered bond supply surged this week with investors piling into deals that offered little new issue concession and negative spreads, leading to concern that an inflection point was at hand. However, there was no sign of investor pushback, with the tightest deals from core European issuers experiencing a high level of demand. But some bankers were left wondering just how long the superb conditions would last.