Most recent/Bond comments/Ad

Most recent/Bond comments/Ad

Most recent

◆ 'Strong demand' supported tight execution, DCM banker said ◆ Landeskbank sought to expand international participation ◆ Concession debated

◆ Dutch lender's latest €2.5bn senior holdco follows Aussie domestic senior foray ◆ Comes a day after $1.5bn AT1 and before green RMBS ◆ Demand for senior unsecured assets is strong as ING clears big funding with limited, if any, new issue concession

◆ Investors eager despite lack of new issue premium ◆ Alpha goes to longest point on Greek banks' maturity curve to give higher yield ◆ Ibercaja's rarity works in its favour

◆ Deal sets new multi-year tight spread for a senior non-preferred euro bond ◆ Sale follows Nordea Bank's seven year senior preferred from last week ◆ Both issuers offer some new issue concession to compensate for low spreads

More articles/Ad

More articles/Ad

More articles

-

◆ US insurance company starts marketing at 'sensible' IPT, says one banker off-deal ◆ But others say it was 'aggressive' ◆ They attribute change of sentiment and relative value difference to US dollars for pulling the deal

-

◆ Unrated by major agencies but no hindrance to issuance ◆ Demand reflects broader risk appetite ◆ Infrequent issuers access seen as key market test

-

◆ The arrival of Piraeus and Bank of New Zealand shows 'investors are engaged' ◆ Greek issuer recently upgraded ◆ Bank of New Zealand returns to euros after five years

-

After unsecured FIG issuance stopped entirely for 19 days in June subscription ratios have since shot up

-

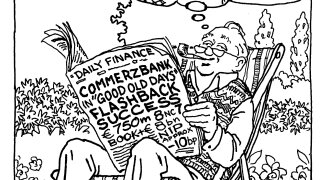

Senior market 'in good shape' with plentiful of liquidity

-

◆ Leads say deal landed well inside fair value ◆ Rivals say result points to ‘halcyon days’ of early 2024 ◆ Other issuers said to be eyeing Rabobank's callable FRN structure