Most recent/Bond comments/Ad

Most recent/Bond comments/Ad

Most recent

◆ 'Strong demand' supported tight execution, DCM banker said ◆ Landeskbank sought to expand international participation ◆ Concession debated

◆ Dutch lender's latest €2.5bn senior holdco follows Aussie domestic senior foray ◆ Comes a day after $1.5bn AT1 and before green RMBS ◆ Demand for senior unsecured assets is strong as ING clears big funding with limited, if any, new issue concession

◆ Investors eager despite lack of new issue premium ◆ Alpha goes to longest point on Greek banks' maturity curve to give higher yield ◆ Ibercaja's rarity works in its favour

◆ Deal sets new multi-year tight spread for a senior non-preferred euro bond ◆ Sale follows Nordea Bank's seven year senior preferred from last week ◆ Both issuers offer some new issue concession to compensate for low spreads

More articles/Ad

More articles/Ad

More articles

-

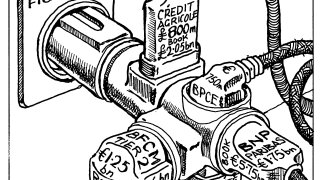

Warm reception for French banks in euros and other currencies shows FIG market is in positive health

-

◆ Landesbank delays covered funding as it prints second senior preferred three months after debut ◆ Varying views on concession, minimum 5bp paid ◆ Strong backing by German bank investors

-

◆ Italian bank overcomes slower day in primary with first FIG dual tranche deal of year ◆ Why issuer chose twin tranches ◆ Concession discussed

-

It was the first senior preferred deal from the bank in two years

-

◆ Investors not chasing last few basis points ◆ Minimal premium paid ◆ Caution on sterling paper

-

◆ Issuer among tightest US insurance companies in euros ◆ Euro volume from the sector reviving ◆ Sterling market has been growing in diversity since 2020