Most recent/Bond comments/Ad

Most recent/Bond comments/Ad

Most recent

◆ 'Strong demand' supported tight execution, DCM banker said ◆ Landeskbank sought to expand international participation ◆ Concession debated

◆ Dutch lender's latest €2.5bn senior holdco follows Aussie domestic senior foray ◆ Comes a day after $1.5bn AT1 and before green RMBS ◆ Demand for senior unsecured assets is strong as ING clears big funding with limited, if any, new issue concession

◆ Investors eager despite lack of new issue premium ◆ Alpha goes to longest point on Greek banks' maturity curve to give higher yield ◆ Ibercaja's rarity works in its favour

◆ Deal sets new multi-year tight spread for a senior non-preferred euro bond ◆ Sale follows Nordea Bank's seven year senior preferred from last week ◆ Both issuers offer some new issue concession to compensate for low spreads

More articles/Ad

More articles/Ad

More articles

-

Window for unsecured FIG syndications closes once more

-

Warren Buffett's conglomerate was the largest foreign issuer of yen bonds last year

-

A covered bond deal a possibility and spreads recover slightly but little incentive for most deals after 'wild' morning

-

FIG issuance plans for next week in doubt after Friday 'meltdown'

-

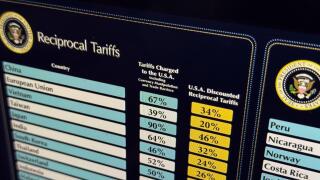

Bright spots in financial and corporate bond markets despite expected economic hit from escalating trade war

-

Next major day for US primary FIG is April 11 — JP Morgan's earnings, which typically heralds heavy new supply