Most recent/Bond comments/Ad

Most recent/Bond comments/Ad

Most recent

◆ 'Strong demand' supported tight execution, DCM banker said ◆ Landeskbank sought to expand international participation ◆ Concession debated

◆ Dutch lender's latest €2.5bn senior holdco follows Aussie domestic senior foray ◆ Comes a day after $1.5bn AT1 and before green RMBS ◆ Demand for senior unsecured assets is strong as ING clears big funding with limited, if any, new issue concession

◆ Investors eager despite lack of new issue premium ◆ Alpha goes to longest point on Greek banks' maturity curve to give higher yield ◆ Ibercaja's rarity works in its favour

◆ Deal sets new multi-year tight spread for a senior non-preferred euro bond ◆ Sale follows Nordea Bank's seven year senior preferred from last week ◆ Both issuers offer some new issue concession to compensate for low spreads

More articles/Ad

More articles/Ad

More articles

-

◆ 'Impressive' result for Spanish bank ◆ Raiffeisen Hungary shows CEE appetite ◆ Ageas places short-dated sterling senior

-

◆ RBC makes fourth visit to euro senior market in 2025 ◆ Fast money sensitive to tightening ◆ Bail-in value vs other jurisdictions evaluated

-

Market participants struggle to justify FIG and corporate bond parade as technicals power primary

-

◆ Spanish bank prints senior bond duo with no new issue premium ◆ Ten year tranche may have had negative concession ◆ FRNs remain popular, in public and private forms

-

◆ Yankee banks top up regulatory capital ◆ Brown & Brown fund $10bn acquisition ◆ Investors hunt for yield

-

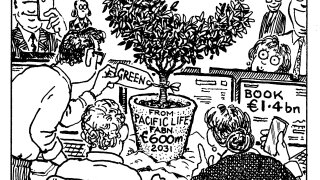

New faces in euros could be thin end of the wedge as Pacific Life introduces first green FABN