Most recent/Bond comments/Ad

Most recent/Bond comments/Ad

Most recent

◆ 'Strong demand' supported tight execution, DCM banker said ◆ Landeskbank sought to expand international participation ◆ Concession debated

◆ Dutch lender's latest €2.5bn senior holdco follows Aussie domestic senior foray ◆ Comes a day after $1.5bn AT1 and before green RMBS ◆ Demand for senior unsecured assets is strong as ING clears big funding with limited, if any, new issue concession

◆ Investors eager despite lack of new issue premium ◆ Alpha goes to longest point on Greek banks' maturity curve to give higher yield ◆ Ibercaja's rarity works in its favour

◆ Deal sets new multi-year tight spread for a senior non-preferred euro bond ◆ Sale follows Nordea Bank's seven year senior preferred from last week ◆ Both issuers offer some new issue concession to compensate for low spreads

More articles/Ad

More articles/Ad

More articles

-

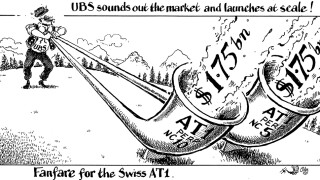

In a year dominated by the collapse and takeover of Credit Suisse, financial institutions were keen to re‑establish investor confidence in some of the riskier asset classes. Axa led the way just weeks after the CS rescue with a €1bn subordinated bond. In the autumn, UBS made a bold statement about the stability of Swiss bank capital as it returned to AT1 issuance with two $1.75bn tranches. Elsewhere, banks dealt with tricky conditions and pulled off some skilfully timed transactions, underlining the market’s faith in mainstream currencies and emphasising the appeal of ESG labels

-

Rate peak joy soothes angst over Austrian collapse, but losses will surface

-

◆ Rate cut expectations raise appeal of bank debt ◆ NBC and Ally Financial push annual issuance to $593bn ◆ Yankee and US regional banks expected to lift supply in 2024

-

◆ Interest rate expectations power demand for higher yielding bonds, duration in covereds ◆ Synthetic indices tighten to fresh 12-month low ◆ Market in rude health for January issuance

-

◆ ECB repayments to influence banks’ covered and SP issuance ◆ But TLTRO repayments less important than this year ◆ Large pre-funding could mean lighter January supply

-

◆ End of year slow down exacerbated by caution ahead of major central bank decisions ◆ Sentiment stays strong albeit some dents after strong US economic data forces changes in rate cut expectations ◆ European banks send RFPs for January issuance