Most recent/Bond comments/Ad

Most recent/Bond comments/Ad

Most recent

French banks lead the charge in euros with tighter than average NIPs

First public Spanish consumer ABS since September

Senior, capital issuance expected on Tuesday, after impact of historic precious metals sell-off is assessed

Domivest’s Dutch BTL trade has provided a benchmark for Citi

More articles/Ad

More articles/Ad

More articles

-

◆ Several factors behind the aggressive pricing technique ◆ Scarcity value pays off in 'super strong' market ◆ Possible refinancing of a called, grandfathered tier two

-

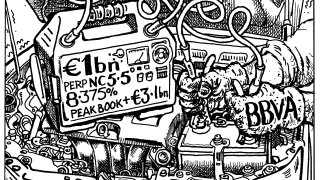

Demand for high yielding paper drives comeback for most subordinated bank capital

-

-

◆ Opco bond choice counteracts wild swings in rates ◆ 'Rrisky strategy' but issuer tightens pricing ◆ Spread buyers lock on to high yield

-

◆ New funding combined with early refinancing ◆ Similar concession to compatriot's AT1 ◆ 'Euphoric' market welcomes subordinated debt

-

◆ Demand skewed towards higher spread products ◆ Niche names to follow ◆ ABN also takes size in Swissies