Most recent/Bond comments/Ad

Most recent/Bond comments/Ad

Most recent

French banks lead the charge in euros with tighter than average NIPs

First public Spanish consumer ABS since September

Senior, capital issuance expected on Tuesday, after impact of historic precious metals sell-off is assessed

Domivest’s Dutch BTL trade has provided a benchmark for Citi

More articles/Ad

More articles/Ad

More articles

-

◆ Two banks print €2bn on the back of almost €5.5bn combined demand ◆ Investors keen to pick up yield through subordinated debt ◆ All this, despite tier two paper trading tighter than a year ago

-

◆ Issuer drives down yield by more than 200bp tighter than where other European national champions printed three months ago ◆ But this means smaller book that raises performance questions

-

Banks deemed 'solid' but risks in credit quality and growing non-preforming loans pose problems ahead in weak economy

-

High net worth Nordic investors have been buying local AT1s as an alternative to equities

-

◆ High yields pull investors into local currency AT1s ◆ SR-Bank to use proceeds to refinance March AT1 call ◆ Will hold tender for existing bond to reduce cost

-

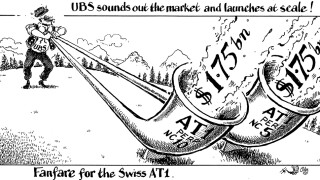

In a year dominated by the collapse and takeover of Credit Suisse, financial institutions were keen to re‑establish investor confidence in some of the riskier asset classes. Axa led the way just weeks after the CS rescue with a €1bn subordinated bond. In the autumn, UBS made a bold statement about the stability of Swiss bank capital as it returned to AT1 issuance with two $1.75bn tranches. Elsewhere, banks dealt with tricky conditions and pulled off some skilfully timed transactions, underlining the market’s faith in mainstream currencies and emphasising the appeal of ESG labels