-

Europe must get to grips with ballooning non-bank financial system

-

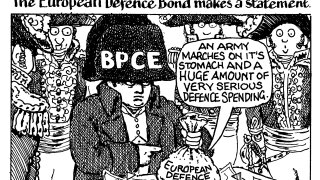

If you want peace, financially prepare for war

-

Markets will lose their bearings without reliable, independent government data

-

The BoE's new MREL regime will be transformative for the UK's smaller banks

-

Why remembrance of things past will soon include the traditional relationship between French covered and sovereign bonds

-

The UK will do better with tactical retreats on regulation than risking being outflanked by the US's wildcat banking regime

-

The British Business Bank in its current form cannot support the UK securitization market

-

The industry’s obsession with appointing co-heads plays into its reputation for competition rather than cooperation

-

Post-management senior positions can be very valuable, but only if handled right

-

Enjoy the roaring markets while you can, they won't last long

© 2026 GlobalCapital, Derivia Intelligence Limited, company number 15235970, 4 Bouverie Street, London, EC4Y 8AX. Part of the Delinian group. All rights reserved.

Accessibility | Terms of Use | Privacy Policy | Modern Slavery Statement | Event Participant Terms & Conditions

Cookies Settings