Europe

-

Issuer was originally looking at a $1bn trade but found healthy demand

-

Fiserv and Visa print across the curve with more tipped to come

-

◆ Swap spread stability enables large $5bn trade ◆ Spread to US Treasuries gets squeezy ◆ Alternative executions considered but not needed

-

The company has refinanced and increased its loan by another €100m

-

◆ ‘Decent book’ 5.3 times covers deal ◆ Third govvie to bring a deal in two days ◆ Valuation still tight versus most peers

-

◆ European and US growth figures released during bookbuilding ◆ Demand proves decent for EDF ◆ Worries bubble up that market is not pricing in risk properly

-

◆ €5bn of green tap executed quickly ◆ Syndications over for 2025 ◆ Strong green demand confirmed

-

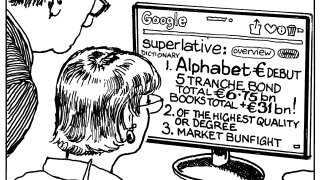

◆ Debut deal from Google owner ◆ Combined peak demand hits €31.5bn ◆ Curve steepens by 3bp during book building

-

◆ TDC Net opens books after marketing last week ◆ Starting spread is widest of any deal for almost a year ◆ Harbour Energy out with junk rated hybrid

-

◆ Hungarian bank brings subordinated debut ◆ Order book allowed 50bp of spread tightening ◆ Absence of senior deals led to 'some surprise'

-

The Manchester based company was advised by debt specialist Alvarez & Marsal

-

Sector analysts say diversity of funding is a core goal for airline leasing companies