Euro

-

Issuer was one of a handful of German SSAs to benefit from a quiet primary market this week

-

Subscription ratio of 5.7 but rival bankers debate premium

-

Bankers away from mandate question fair value estimate from syndicate

-

US issuer lands 'outstanding' deal, prompts hopes it could spur Reverse Yankee issuance

-

◆ Leasing company returns at the three year part of curve a month after issuing €1.5bn in fours and sevens ◆ New deal adds more supply to frequently tapped short end of the curve ◆ Pays about 5bp-10bp NIP but prices tighter than recent three and four year notes

-

Investors ‘could become more selective’ over 10 year deals

-

Embattled company’s long dated spreads resilient despite new defensive plan and S&P downgrade

-

Euro bond investors put in orders 5.1 times the deal size as issuers smash records

-

◆ Deal ends with the largest book for a BPER senior trade GlobalCapital has tracked in recent years ◆ Pricing is flat if not inside FV ◆ Green deal sends encouraging signals to the periphery's other less frequent issuers

-

Europe’s IG corporate bond market is in danger of finding out how many straws it takes to break a camel’s back

-

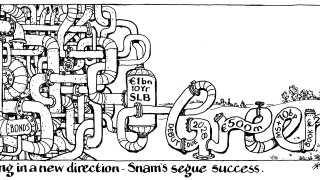

Italian gas group wins big book for debut green tranche

-

Some rival bankers said ‘wrong day’ to issue as spread debated