Most recent/Bond comments/Ad

Most recent/Bond comments/Ad

Most recent

Gulf investors 'will now look at every deal', whether sukuk or not

Demand from the Middle East for the sukuk was steady

Bond pricing for the mining company started about 43bp back of its parent

Sovereign wealth fund takes $2bn, as aimed at

More articles/Ad

More articles/Ad

More articles

-

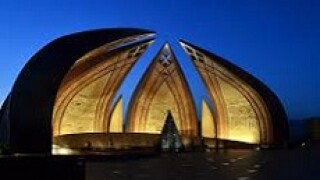

The Islamic Republic of Pakistan raised $1bn from a five year sukuk at a record low coupon on Wednesday. The deal affirmed the country’s ability to raise funds from international investors, which are growing more confident about its economic prospects.

-

The Islamic Republic of Pakistan is returning to the international debt market for a dollar sukuk after a gap of two years.

-

A range of credits from India, Malaysia and Greater China stormed the Asian debt market on Thursday, vying for investor attention.

-

The CLO market's best hope of easing risk retention rules is likely to come during a lame duck session of Congress, given the highly politicised atmosphere leading up to the US Presidential and Congressional elections in November.

-

Emaar Properties made a triumphant return to the sukuk market on Wednesday with a tightly priced 10 year dollar bond.

-

Sukuk stepped into the spotlight after JP Morgan decided to include Islamic bonds in its EM bond indices, but while eligibility will give the asset class a boost, it will be a while before the product is more broadly used.