Most recent/Bond comments/Ad

Most recent/Bond comments/Ad

Most recent

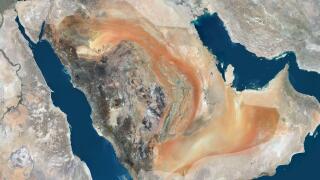

Gulf investors 'will now look at every deal', whether sukuk or not

Demand from the Middle East for the sukuk was steady

Bond pricing for the mining company started about 43bp back of its parent

Sovereign wealth fund takes $2bn, as aimed at

More articles/Ad

More articles/Ad

More articles

-

Turkey's banks rarely offer public sukuk

-

Sukuk from Egypt, priced on Tuesday, have proved just as popular in the secondary market as it was in syndication

-

Yields are far, far lower than when Egypt last printed in the format

-

Saudi mortgage provider will offer a premium to its sovereign, and deal will carry a guarantee

-

The Saudi mortgage provider trades about 15bp-20bp over the Kingdom's curve

-

Property company's sukuk comes two months after $500m sukuk