EMEA

-

◆ 12 year deal to be Achmea's longest since 2021 ◆ Rabobank's recent 12 year provides closest comparable

-

◆ Five year trade among the tightest this year ◆ Small single digit premium needed to seal the deal ◆ Investors came in after pricing despite the tight spread

-

-

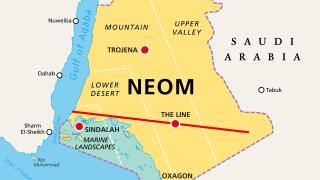

The Saudi wealth fund and sovereign have issued tens of billions of dollar bonds in the last two years

-

Unrated names and a new hybrid issuer plan deals, as bankers warn 2024 will be a '10 month year'

-

Subdued SSA dollar market is also getting a boost

-

Fair value is about 180bp over mid-swaps says a banker on the trade

-

Books will open on Sunday for Aramco’s first follow-on since IPO

-

Books were two times covered for three Gulf banks bonds this week

-

Wide spreads have insulated eurozone periphery borrowers from rates volatility — for now

-

The prices on offer mean little pushback from investors when Saudi Arabia issues more than planned

-

French agency hopes to be a regular in sterling market