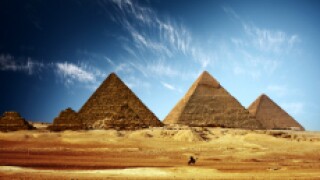

Middle East Bonds

-

The Middle East and North Africa region will provide a large chunk of emerging market bond supply in 2019, investors said this week. The region provides excellent value, in spite of fluctuations in the oil price.

-

Dubai Investments Park Development Company has postponed its planned dollar five year sukuk.

-

A fresh round of US sanctions on Venezuela’s government will add to the pressure on 46th president of Venezuela Nicolas Maduro to clear off, said bond investors.

-

Georges Elhedery will be moving from Dubai to London in order to take up a new role as head of global markets at HSBC. He replaces Thibaut de Roux, who reportedly left in September after an accusation of inappropriate conduct.

-

Dubai Investments Park is hitting the road to market a five year fixed rate senior unsecured Reg S only sukuk.

-

Qatar National Bank has sold a Rmb500m ($73m) three year bond through Standard Chartered, continuing its ongoing presence in this market.

-

Qatar plans to buy $500m of Lebanese government bonds, providing the beleaguered country with a slight reprieve from its bond market woes.

-

-

-

First Abu Dhabi Bank (FAB) printed its $850m five year sukuk on Tuesday, becoming the first bank to sell an international sukuk intraday.

-

First Abu Dhabi Bank printed its $850m five year sukuk on Tuesday, increasing the deal size from an expected $750m and paving the way for an additional tier one trade from Dubai Islamic Bank on Wednesday. The deals are the first bank trades from the Middle East this year.

-

Dubai Islamic Bank finishes the roadshow for its additional tier one bond on Wednesday. The market is eagerly awaiting pricing details and though no call has yet been confirmed, bankers and investors are expecting the bank to redeem its outstanding tier one in March.