Middle East Bonds

-

-

The clean energy firm attracted orders over $3.7bn by midday in London

-

The main comparables will be bonds from its shareholders such as Taqa and Mubadala

-

Lower than expected inflation in the US has given EM issuers a boost heading into summer

-

Real estate firm eyes the market after a week of US Treasury yield yo-yoing

-

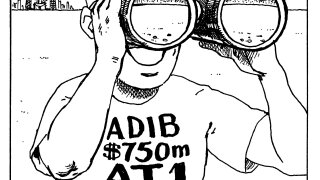

Despite ADIB's success, many EM issuers will be unable to refinance their AT1 bonds

-

'Spectacular' book of over $7bn in first EM deal since Credit Suisse

-

The reason for a no call is an important detail. The rules of the game don't always apply when conditions are tough

-

The real estate firm broke new ground in the GCC by inserting a call option

-

Deal from UAE real estate developer is scheduled for next week

-

-

Bond trades softly after sharp rise in Treasury yields during execution