Derivs - People and Markets

-

CME Group is set to introduce six currency futures with monthly expiries.

-

Major derivatives exchanges have released figures showing growth over 2016 and in December, with big gains reported in some product lines.

-

John Maynard Keynes said we live in a world of irreducible uncertainty, while neoclassical economists assume that perfect information is available and people have rational expectations. The events of the past decade suggest that the former school of thought has more credence, though “freshwater” economists would no doubt disagree.

-

Hong Kong Exchanges and Clearing (HKEX) plans to introduce options on the Chinese renminbi currency, as well as a US dollar/offshore renminbi contract, having gained approval from the Securities and Futures Commission of Hong Kong.

-

Timothy Massad, chairman of the US Commodity Futures Trading Commission, has resigned, with Republican commissioner J. Christopher Giancarlo widely expected to take up the job.

-

The plans of London Stock Exchange Group and Deutsche Börse to pursue a merger of equals received a boost this week, as rival exchange Euronext agreed terms with the LSEG to buy its Paris clearing house business LCH SA in an all cash offer.

-

Anshu Jain, former co-chief executive of Deutsche Bank, is joining Cantor Fitzgerald as president.

-

In 2016, blockchain went from a buzzword to a ‘must have’ in financial markets, as seemingly every bank and exchange invested in projects and proofs-of-concept. But with so many asset classes having been promised big gains, 2017 begins with a dose of realism about the limits of the technology — and the challenges it poses for regulators. Dan Alderson reports.

-

The Brexit vote and the election of Donald Trump laid bare the poor predictive power of the massed ranks of financial analysts and traders. But when these political cataclysms hit the screens, nothing broke. Everyone from the IMF down to the lowest financial scribbler has warned that markets are less resilient thanks to regulation — but in the turmoil following these votes, prices moved but institutions stayed solid. Owen Sanderson reports.

-

The upending of global financial markets in the second half of 2016, driven by shocks from the UK’s Brexit vote and US presidential election, has caused a breakdown in previously dominant cross-asset correlations and a sharp resizing of event risk in 2017. Dan Alderson reports on a wave of structured product innovation aimed at navigating this new and more volatile universe.

-

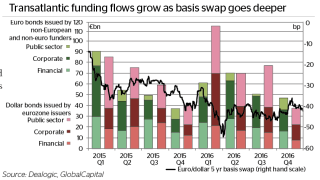

Cross-currency swap markets face a rough start to 2017. Traders fear that diverging central bank policy, a shift in corporate borrowing dynamics and a repatriation of US money will all upset the basis at different parts of the curve. Dan Alderson reports.

-

The European Securities and Markets Authority wants more convergence between central counterparties on how they comply with margin and collateral requirements.