Derivs - FX

-

Hedge funds are showing increased appetite for offshore yuan, U.S. dollar target redemption forwards, buying between USD10-to-11 billion in notional volume last Thursday, for example.

-

Capital flight from emerging markets has been the dominant theme in the credit markets so far this year, but over the past week the concerns have dissipated.

-

The London Stock Exchange is seeing increased interest in its Italian dividend futures offering, predicting further growth in the instrument over the next 12 months.

-

Investors should enter a March/June/September calendar fly on the Nikkei 225, selling a June 2014–September 2014 call calendar at a 2:1 ratio with a 16,000 strike and buying a March 2014 16,000 call to mitigate the gamma.

-

Investors have been picking up short-dated options on sterling versus the U.S. dollar as interest in GBP has spiked in anticipation of the Bank of England's quarterly inflation report which was released Wednesday.

-

Investors have been picking up risk-reversals and butterflies across a range of currency pairs following a drop in volatility on the back of the European Central Bank and Bank of England interest rate meetings today.

-

Demand for Athena structured products on EUR/USD is increasing as investors become more willing to put capital at risk to take a bearish view.

-

R. Martin Chavez, chief information officer for Goldman Sachs in New York, will receive the Outstanding Contribution Award at the Americas Derivatives Awards on April 22. Chavez, who was selected for the award by senior buyside and sellside officials active in the derivatives markets, will be honoured for his contribution to the development of the derivatives market through his role at the International Swaps and Derivatives Association, as well as his success in developing Goldman’s Equities Franchise, among other areas. The full list of award categories and nominees can be accessed at www.derivativesweek.com.

-

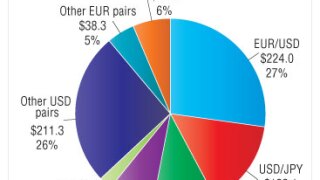

Average daily volume in over-the-counter fx instruments in the U.S. in October 2013 totaled USD816 billion, 19% down on April 2013, according to results of a survey released by the Foreign Exchange Committee of the Federal Reserve Bank of New York.

-

The Australian Securities and Investments Commission is considering waiving specific trade reporting requirements for international firms active in the over-the-counter derivatives market, and is currently in discussions with market participants over the issue.

-

Newly created domestic central counterparties in Asia may largely lose out to international CCPs following the introduction of mandatory clearing this year.

-

Investors should look at entering reverse knock out options referencing the Australian dollar, U.S. dollar cross with a strike at 0.82 and buying a three-month put with a strike at 0.87.