Derivs - FX

-

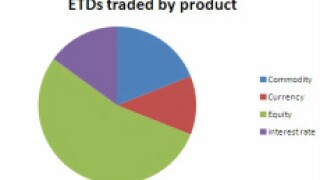

The number of exchange-traded derivatives traded worldwide increased by 3% to 22bn contracts last year, according to statistics compiled by the World Federation of Exchanges.

-

Julius Baer has launched a new execution-only trading platform that will give its clients in Switzerland access to more than 20,000 instruments across equities, foreign exchange, precious metals and commodities.

-

The Hong Kong Exchange is looking at introducing renminbi currency options this year should liquidity in RMB futures contracts continue to increase.

-

Brent Eastburg, global head of credit trading at Standard Chartered in Hong Kong, is to leave the firm.

-

Expertise in cross-asset products, a concise understanding of cross-border regulatory issues and a proficiency in both local and global market demands are the requirements for any senior executive to succeed in the derivatives markets. Bob Ray, ceo of CME Europe, possessed all of those qualities.

-

Hedge funds in the US are buying three-month out-of-the-money put spreads on emerging market underlyings, such as the Vanguard FTSE EM exchange-traded fund and the iShares MSCI EM index, in a bid to hedge greater outflows from EM markets.

-

From time to time, an investment opportunity presents itself as a “sure thing”–highly likely to deliver above-average returns. If you’re skilful, or lucky enough to be provided with such insights on a regular or systematic basis, a lucrative career in asset management beckons. If not, invitations to access the insights of others are easily procured, albeit in exchange for a fee.

-

ABN Amro Clearing has launched a new global execution platform, AMG Global, which aims to provide the firm’s clients with routing capabilities between Asia, US and Europe for equities and futures trading via a single FIX connection.

-

A total return swap has emerged in a novel situation: a power industry pre-packaged bankruptcy. Under the TRS, a unit of private equity shop Energy Capital Partners will have voting power in bankrupt power generator MACH Gen after entering a contract with Deutsche Bank, which holds second-lien debt in MACH Gen.

-

CVA and loan desks are buying April to June payers between 15bp-20bp out-of-the-money on the iTraxx Main and CDX IG volatility, reflecting the more cautious tone in credit markets over the political tensions in Ukraine.

-

UBS has begun marketing capped outperformance certificates, also known as speeders, on the Eurostoxx Banks index. The issuance comes as the index continues to see upside call option flow as investors look to take advantage of the outperformance of eurozone banks.

-

Peter Fung, managing director and senior equity derivatives trader, and Guillaume Kaminer, director and index flow trader at Bank of America Merrill Lynch in Hong Kong, have left the firm.