Derivs - Equity

-

StormHarbour has begun offering broker-dealer services in Tokyo as part of the integration of NSH Securities Co., which was recently acquired by the company.

-

A single European central counterparty backed by the European Central Bank is still being considered by some members of the European Parliament, according to Kay Swinburne, member of the Parliament’s Economic and Monetary Affairs Committee.

-

Exchanges have already begun the process of preparing to set up clearinghouse capabilities for over-the-counter derivatives in Canada, senior exchange officials told Derivatives Week.

-

Some derivatives lawyers are working on a strategy for large endusers to snuff out the practice of rehypothecation—where dealers use collateral pledged by a customer to back the sellsiders own trades.

-

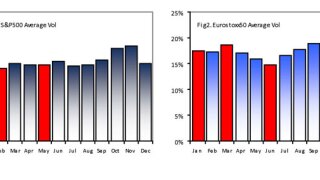

This week, we look into the seasonality of the realised volatility of the S&P 500 and the Eurostoxx50.

-

Clarke Pitts, global head of equity derivatives at Daiwa Capital Markets in London, has reportedly left the firm.

-

Korea has vowed to support financial markets and ensure sovereign credit default swap spreads and non-deliverable forward rates recover. The two rose sharply after the North Korean attack on Yeonpyeong Island.

-

HSBC has hired Jack Busta as managing director and head of equity derivatives flow trading for Asia in Hong Kong. He is the former co-head of equity derivative sales and trading in Moscow for Deutsche Bank.

-

Tim Hart, global head of equity derivative sales and co-head of equities at Deutsche Bank in London, resigned on Friday.

-

A new stress test for systemically important financial institutions has been outlined by risk academic Darrell Duffie, professor at Stanford University.

-

Fewer swaps than Congress and the public expect may end up getting traded on exchanges or through swap execution facilities, according to a Securities and Exchange Commission official.

-

The U.S. Securities and Exchange Commission has hired two industry professionals as structured finance and new product specialists in the New and Structured Products Unit within the Division of Enforcement.