Derivs - Equity

-

The Monetary Authority of Singapore will not require foreign regulators seeking data from its trade repositories to provide indemnification against litigation.

-

William Lee, managing director and head of equity derivatives Asia Pacific at JPMorgan in Hong Kong, is leaving the firm.

-

Bank of America Merrill Lynch had lost Zahid Biviji, managing director and head of single stock flow trading and corporate derivatives, and Tom Kertelits, a director in the same group in New York.

-

The Securities Industry and Financial Markets Association has called for changes to plans by U.S. exchanges and the Financial Industry Regulatory Authority to revamp market-wide circuit breakers.

-

Alternative proposals in Europe for non-equity pre-trade transparency in the Markets in Financial Instruments Directive II will be considered, although it is too early to say what form such rules will take, according to Markus Ferber, Member of the European Parliament, who is heading up MiFID for the Parliament’s Economic and Monetary Affairs Committee.

-

Hedge funds and real money accounts have been buying short-dated vol via equity options over the last week. Trades have included one-to-three-month upside calls referencing Hong Kong’s HSCI and HSI.

-

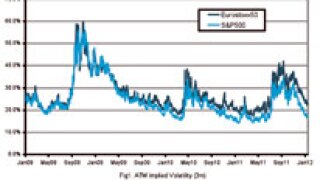

Considering the continued fear over the future of Greece within the Eurozone, and the potentially calamitous outcome if there was to be a disorderly exit from the region in the near term, it is surprising how volatility has reverted to almost pre-crisis levels.

-

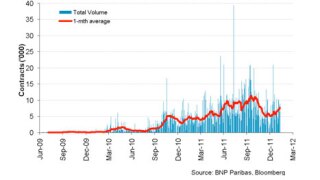

Equity structurers at JPMorgan in Europe are monitoring Vstoxx liquidity closely in the hopes of creating an index that provides long volatility exposure to European equities. The index would mirror the strategy of the firm’s Macro Hedge Total Return Index that references the VIX.

-

A pickup in listed call option volume on fixed income exchange-traded funds has spurred some market participants to suggest that a handful of fixed income ETFs represent better plays than equity strategies, despite equities being cheap relative to bonds.

-

Members of the European parliament are undecided over the makeup of a potential E.U. financial transaction tax and whether it would benefit or damage the economy.

-

Revenue from fixed income, commodities and fx is expected to fall 30% at European banks when they issue their earnings reports this week and 20% at U.S. banks in 2011, according to Société Générale’s Cross-Asset Research team.

-

Clearing of over-the-counter interest rate swaps via Singapore Exchange’s central clearing counterparty DerivativesClear rose in January for the first time in three months to SGD12.92 billion (USD10.34), from SGD1.26 billion (USD1.01) in December.