Derivs - Equity

-

Ian G. Smith, managing director and head of program trading and synthetics at Goldman Sachs in Hong Kong, has left the firm.

-

Frankfurt-based index provider Solactive is in discussions with issuers to develop structured products linked to its newly launched Green Bond Index, the first underlying of its kind.

-

Henry Homes, an equity derivatives flow salesman at Credit Suisse in New York, is set to join Nomura in a similar role, also in New York.

-

Bank trading desks have been actively selling April 1x1.5 call ratios on the Nikkei 225 this week, targeting strikes between 15,250-and-16,000 in a bid to sell upside skew while remaining neutral on volatility.

-

Singapore Exchange plans to launch options trading on China A50 futures in the third quarter this year and will also expand its suite of foreign exchange Asian currency futures to include renminbi around the same time.

-

Multilateral trading facilities in Europe are asking the Commodity Futures Trading Commission for more time to apply to become "qualified" or equivalent to swap execution facilities as the expiry date on the commission’s no-action relief letters fast approaches.

-

Marcus Consolini, the ex-head of electronic execution sales and trading, Asia at JPMorgan in Hong Kong, has joined Société Générale.

-

Uncertainty surrounding China’s netting regime still presents a substantial risk for foreign financial firms wanting to enter into transactions with mainland counterparties, despite recent interpretative guidance on “set off” provisions from China’s Supreme People’s Court last year.

-

Hedge fund Citadel Asset Management has opened an office in Greenwich, Conn., and plans to replicate the capabilities of its Global Equity and Global Fixed Income multi-strategy and single strategy funds from the location.

-

Natixis has hired Eric Le Brusq, the ex-global head of equities and derivatives sales at BNP Paribas in London, as global head of equity derivatives sales, also in London.

-

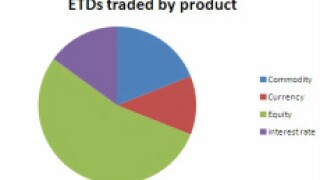

The number of exchange-traded derivatives traded worldwide increased by 3% to 22bn contracts last year, according to statistics compiled by the World Federation of Exchanges.

-

Julius Baer has launched a new execution-only trading platform that will give its clients in Switzerland access to more than 20,000 instruments across equities, foreign exchange, precious metals and commodities.