Derivs - Credit

-

The International Swaps and Derivatives Association will tighten up the rules governing members of its Credit Derivatives Determinations Committee as it looks to strengthen the process for deciding whether credit events have occurred.

-

TABB Group, a research and consulting firm focused on capital markets, has hired two analysts to its derivatives practice.

-

ISDA has extended until Friday its deadline to rule on whether Novo Banco has triggered a credit or succession event, after a fourth successive day of grappling with these questions failed to achieve an answer.

-

Markit, the financial information services firm, has agreed to buy Loan/SERV technology assets from the Depository Trust & Clearing Corporation (DTCC) in a bid to expand its loan management services.

-

The fate of credit default swaps referencing Novo Banco still hung in the balance on Friday, with ISDA’s Determinations Committee unable to decide after three days of wrangling whether the Portuguese bank had triggered a government intervention credit event or a succession event.

-

Back in August 2014, I wrote a note that highlighted how the restructuring of Banco Espirito Santo (BES) exposed flaws in the 2003 ISDA credit default swap definitions, flaws that should be remedied by the new definitions introduced later that year.

-

ISDA’s Determinations Committee has decided to hold a second day of discussions on Novo Banco, after failing to reach agreement on Wednesday over whether the Portuguese bank has triggered a government intervention credit event or a succession event.

-

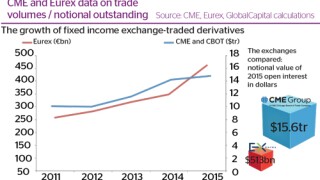

Competition between derivatives exchanges is intensifying, giving rise to a rash of product and platform launches in 2015, as well as geographical expansion. But 2016 will be dominated by regulatory deadlines for electronic trading. As Dan Alderson reports, exchanges that best prepare market participants to meet these requirements will be the ones that will win out.

-

2015 will be remembered as a year when volatility returned to financial markets. With strong technical buffers to the trading range of US and European equity markets going into 2016, short volatility strategies look set to be compelling money earners in the year ahead, writes Andrew Barber.

-

ISDA’s Determinations Committee will meet at 12pm London time on Wednesday to decide whether Portugal’s Novo Banco has triggered a government intervention credit event, but will also deliberate a succession event in relation to the transfer of senior bonds to Banco Espirito Santo.

-

The International Swaps and Derivatives Association this week published an initial list of 35 bonds to be considered as deliverables in the forthcoming Abengoa credit event auction, which will settle 2014 credit default swaps, but not updated 2003 transactions.

-

Any hopes among European credit traders of easing back into 2016 with a peaceful first week were shattered from the outset on Monday, as spreads gapped wider due to China’s stock market woes and oil price volatility arising from Saudi Arabia’s new stand-off with Iran.