Derivs - Credit

-

The majority of the names referenced in the current Markit index of North American investment grade corporate credit default swaps—the CDX.IG.18—have negative basis, according to a report by Markit.

-

Tradeweb plans to add single-name credit default swaps referencing investment-grade corporates on its electronic trading platform by the end of next month, according to several market participants.

-

Jamie Dimon, JPMorgan president and ceo, told U.S. senators today that the firm’s chief investment office had intended its wrong-way credit derivatives trades to hedge against a crisis, a position that leaves the distinction between a hedge and an investment under the so-called Volcker rule still unclear.

-

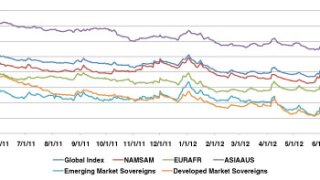

Credit default swaps referencing emerging market countries are now on average more liquid than CDS referencing developed market sovereigns, according to a report released today by Fitch Solutions.

-

Hedge funds have been selling September out-of-the-money payer options on the Markit investment grade credit default swap index and buying puts on the Standard & Poor’s 500 over the last week in order to take advantage of the relative value of credit and equity volatility.

-

Hedge funds have been buying U.S. dollar puts against emerging market and high beta G10 currencies this week. The trades position for a dollar retracement after risk aversion last week may have over-strengthened the greenback.

-

Hedge funds that bought outright protection on the Markit iTraxx European Senior and Subordinated Financials indices to hedge exposure to French banks are trying in vain to unwind positions as European markets have rallied.

-

Morgan Stanley is said to have reopened its fixed-income trading desk in Canada after it had been closed for more than a decade.

-

The Securities and Markets Stakeholder Group, an influential division of the European Securities and Markets Authority, has criticized a proposal from the pan-European regulator for technical standards on margin calculation models for central counterparties.

-

The Markit index of credit default swaps referencing Latin American corporate is most weighted toward five energy companies, according to a draft of the index constituents provided to DI.

-

Adjusted volumes of over-the-counter non-fx derivatives have dropped by 10.3% over the last year to USD400 trillion largely because of portfolio compression, according to an analysis by the International Swaps and Derivatives Association.

-

Japanese financial firms with over-the-counter derivatives holdings have not adequately decreased their wrong way risk--the combination of counterparty credit risk and market exposure--since the collapse of Lehman Brothers, according to Japan’s central bank.