Derivs - Credit

-

Strategies that use so called smart beta indices, or benchmarks that deviate from a market-weight approach, could be leading to a clustering of positions and an eventual unwind.

-

High frequency trading of liquid treasuries and swap products is expected to get easier from next year when the FIX trading protocol is drafted for the market.

-

European swap platforms are looking to match the language they use for swap trading to the language used by the bulk of swap execution facilities in the US, despite a breakdown in negotiations for mutual recognition between US swap execution facilities and their European equivalents, multilateral trading facilities.

-

The European credit default swap market is made up of no more than ten highly-connected major players and could withstand a major shock, such as a credit event to one of them, but would suffer grave consequences if two institutions were hit simultaneously, according to a new study by the European Securities and Markets Authority.

-

A New York Court of Appeals decision on Tuesday to allow proceedings in a breach of fiduciary duty suit, brought against an insolvent credit default swap issuer, will make it easier for creditors to pursue insolvent issuers in the courts.

-

The International Swaps and Derivatives Association has warned that mandatory clearing for over-the-counter equity derivatives could see volumes migrate to the exchange-traded market, diminishing the role for the OTC contracts in risk management.

-

Hedge fund investors are entering one-year capped variance and volatility swaps on baskets of stocks and exchange-traded funds with the view that some correlated underlyings will disperse in the near future against those that are likely to remain stable.

-

UBS has hired Jerry Kao, former director, equity derivatives trader at Deutsche Bank in New York.

-

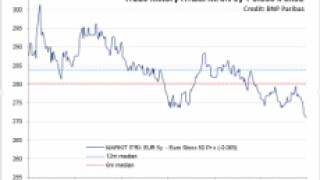

Hedge funds and fast money investors are going long the Eurostoxx 50 and shorting iTraxx Main despite a snap tighter on iTraxx indices and CDS after the European Central Bank announcement on Thursday.

-

Credit investors will remember the summer of 2012 as the turning point of the eurozone sovereign crisis. Mario Draghi’s “whatever it takes” intervention caused a decisive shift in sentiment and triggered a long rally that has lasted to this day.

-

The Markit iTraxx Senior Financials index tightened 4 basis points to 68bps on Thursday after the European Central Bank cut interest rates to combat low inflation and drive growth in the Eurozone. The move by the central bank followed increased flow in the index with hedge funds buying receivers and selling payers on the underlying.

-

Edward Smalley, iTraxx options trader at Barclays in London, has left the firm.