Maybank

-

◆ Maybank gathers sticky, high quality demand ◆ No premium needed ◆ Prima prices tight

-

Deal will be secured against a pool of Singaporean residential mortgages

-

Lender's Singapore entity could issue its debut euro covered bond following non-deal roadshow

-

Vietnamese firm wraps up second fundraising of the year as sentiment towards the country's borrowers shows signs of turning

-

Michael Oh-Lau Chong Jin has been with the Malaysian bank for nearly three decades

-

Malaysian group seeks bank funding for oil project in offshore Brazil

-

-

-

It is the latest Vietnamese FIG credit to tap the loan market

-

New listings gain traction as pipeline builds, with ECM bankers optimistic for the rest of the year

-

Indonesian oil and gas major makes loan debut but would have to steer the deal through some sceptical lenders

-

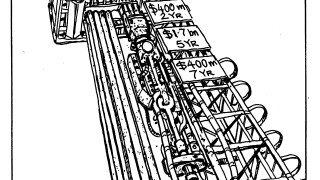

The jumbo $2.5bn loan is expected to be launched to the market in mid-July