CIBC World Markets

-

Canada throwing full weight behind plan for new multilateral lender for defence funding

-

◆ Canadian bank priced the only covered bond on Tuesday ◆ Lead said issuer paid just outside fair value ◆ Sfr325m deal was 'a strong outcome'

-

Canadian bank has been building its European SSA business

-

Market participants hope more jurisdictions will follow as Canadian duo attract record demand

-

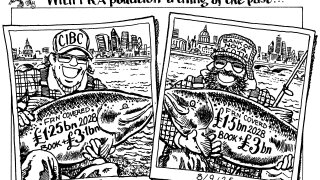

◆ Possible record demand for first non-UK benchmark since PRA debacle in April ◆ Deal lands flat to fair value and euros ◆ Market hopes more names will follow

-

◆ First offshore deal in sterling since PRA debacle in April ◆ Canadian undersupply driving demand ◆ Euro still better despite the UK Treasury's equivalence plans

-

CIBC raises deeply subordinated debt capital in dollars as diverse set of foreign lenders print senior bonds

-

◆ Canadian lender completes biggest euro funding since 2020 ◆ Third deal in Canadian bank series ◆ Euro proves 'attractive' for these issuers

-

◆ 'Special trade' for the Dutch agency ◆ Bankers agree on NIP ◆ AIIB trade gives demand signal

-

◆ CIBC takes large share of the covered bond limelight as market tone improves ◆ SEB returns to euros for the first time in two years ◆ Outcomes likely to attract other issuers, say bankers

-

◆ Agency prints ahead of 'Liberation Day' ◆ Proactive approach to funding this year leaves issuer in good place ◆ Ten year euro social bond still in pipeline

-

◆ Dollar basis working for euro issuers in five year ◆ Maturity working for issuers in 2025 ◆ Deals come a day before Trump tariff announcement