Covered Bonds

-

Issuers will probably have to ‘re-establish’ new issue premiums at a higher level

-

Banker who helped bring covered bonds to Singapore and grow the market globally

-

Covered and unsecured issuers await greater stability, despite positive signs in secondary

-

The issuer is also looking to end a six year absence from publicly placed RMBS

-

Exceptional moves in rates could impact relative value across the FIG capital structure

-

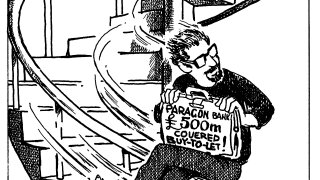

◆ Deal the first publicly placed UK covered bond secured on buy-to-let mortgages ◆ Saving spotted versus RMBS ◆ Low double digit pick-up needed over prime UK paper

-

Credit market conditions strong as rates demand slows

-

◆ Rates and geopolitical volatility weigh on investor sentiment ◆ Fast money investors show price sensitivity ◆ Low single digit premium paid

-

When an investment bank splashes out on a big money rockstar hire, it’s not just a transaction or a rejig of the org chart; it’s a public statement of intent as well as a high profile bet that comes with a lot of buzz, bravado, and backbiting

-

Leads to use comparables ranging from South Korea to Denmark when pricing upcoming deal

-

German issuer's own comparable tenor deals disregarded in favour of more recent peer supply

-

Investors keen on duration as Thermo Fisher and Pfandbriefzentrale also go longer