Southpaw

Top Section/Ad

Top Section/Ad

Most recent

Physical infrastructure, once seen as boring and ex-growth, has become one of the hottest areas for capital markets and M&A, and that is set to accelerate in 2026

Hit by an alleged ‘fraud’ at the bankrupt US car parts maker, Wall Street’s last pure play investment bank has its sights set on European leveraged finance as it expands its alliance with SMBC

Mid-market firm has growing ambitions following its acquisition of Bryan Garnier

UK bank set to increase the pace in corporate and investment banking and create conditions for a smooth CEO succession

More articles/Ad

More articles/Ad

More articles

-

The Spanish bank is building out its industry and product teams after doubling down in North America

-

UK house has boosted returns at its investment bank and is bullish on ECM and M&A despite falling below expectations

-

Goldman Sachs has taken collaboration to the next level in a quest to dominate private and public capital markets

-

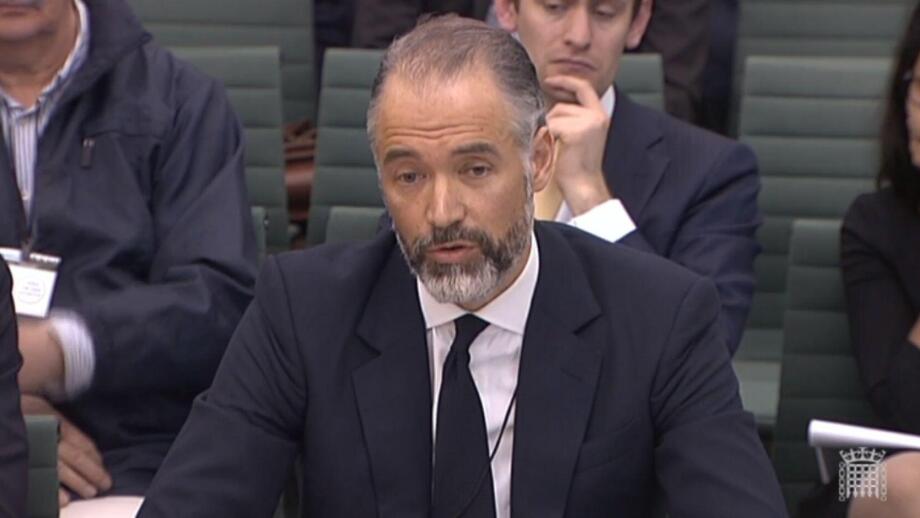

Viswas Raghavan’s move to Citi from JP Morgan 18 months ago has shaken up both institutions and provoked an intense Wall Street rivalry

-

Banks welcome UK’s relaxed prospectus rules as IPO pipeline swells

-

With Sergio Ermotti set to step down as group CEO, chairman Colm Kelleher favours an orderly, internal succession. But in a critical year for the bank, there could be turbulence ahead