Top Section/Ad

Top Section/Ad

Most recent

Asian buyers driving callable SSA market have resurfaced in public benchmark deals

Public sector issuers have become more flexible when executing cross-currency interest rate swaps

Politically motivated prosecutions endanger democracy

Solutions exist but political will is necessary

More articles/Ad

More articles/Ad

More articles

-

-

It felt like a great weight had been lifted from financial markets this week. Two weights in fact.

-

The way the EU handles Banca Monte dei Paschi di Siena will yet again set a precedent for other struggling banks.

-

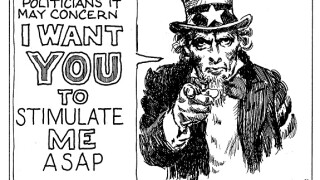

Just because it seems unlikely that in the US election the Democrats will take both the White House and the Senate, it does not mean that capital markets should become despondent about a fiscal stimulus package that could have reached $2.3tr had the so-called "blue wave" made a clean sweep.

-

Take advantage of low borrowing rates to enact ambitious social programmes. That is economists' message to governments in the developed world right now. The message could also apply elsewhere.

-

Capital markets players have a variety of stances on the forthcoming US presidential election. A survey by UBS this week found 51% of wealthy US investors wanted Joe Biden to win, while 55% of business owners favoured Donald Trump.