Top Section/Ad

Top Section/Ad

Most recent

Asian buyers driving callable SSA market have resurfaced in public benchmark deals

Public sector issuers have become more flexible when executing cross-currency interest rate swaps

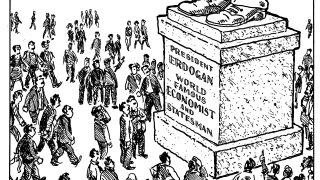

Politically motivated prosecutions endanger democracy

Solutions exist but political will is necessary

More articles/Ad

More articles/Ad

More articles

-

Deteriorating issuance conditions could make a tough MREL buildout even tougher for straggling Greek banks

-

-

With capital markets set to turn rougher, borrowers have been compelled to issue their toughest trades first

-

An uprising in Turkey inspired by the protests this week in Kazakhstan would not be a huge surprise

-

A well telegraphed change in monetary policy from the US Federal Reserve has spared emerging market bonds from the mayhem of 2013

-

The ECB is wrapping up its Pandemic Emergency Purchase Programme but don’t let that dishearten you