Top Section/Ad

Top Section/Ad

Most recent

Asian buyers driving callable SSA market have resurfaced in public benchmark deals

Public sector issuers have become more flexible when executing cross-currency interest rate swaps

Politically motivated prosecutions endanger democracy

Solutions exist but political will is necessary

More articles/Ad

More articles/Ad

More articles

-

Lack of deals is keeping margins low, but volume and risk will return

-

Bank must accept a perfect deal may not be possible while it has Russia exposure

-

European financial institutions should not neglect investors wanting supply in the belly of the curve

-

Tourist money is feeding a CEEMEA bond bonanza, but crossover buyers’ renascent love for EM brings many red flags

-

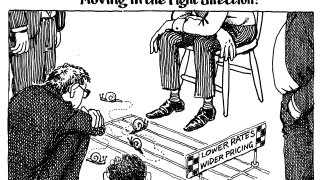

Issuers should take cue from the EIB's persistent chipping away at its funding need

-

European insurance companies should make the most of favourable conditions to grow nascent asset class