Top Section/Ad

Top Section/Ad

Most recent

Weak or half-hearted response to Greenland threats will leave markets crumbling

Over the last week the US president has pushed to make homes and consumer credit more affordable but these policies risk unintended consequences

Issuance volumes may be high but demand is even higher. Credit issuers in particular should take full advantage

Hounding the Fed does not make the US bond market more attractive

More articles/Ad

More articles/Ad

More articles

-

Smaller borrowers beware: market hazards may be larger than they appear

-

FTX has further exposed the dangers of cryptocurrencies, but to regulate the crypto world would be to multiply its risks

-

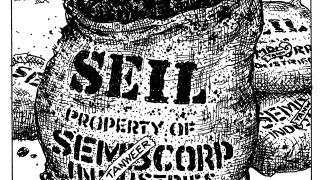

The Singapore group is selling Indian coal plants to avoid a step-up — but is it really quitting them?

-

With the traditional investor base taking a step back this year, a return could result in consecutive record issuance

-

For shareholders and companies, getting along is much easier in a bull market

-

Apollo and Pimco’s prospective purchase has been described as a ‘bad bank’, but some have reservations