Citi

-

Thai oil and gas company PTT Public Co sold the first 50 year bond from an Asian corporation on Thursday, raising $700m from a tightly-priced deal.

-

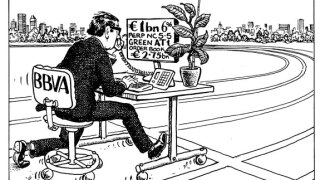

BBVA has become the first bank to print a green additional tier one (AT1) deal. When it was issued this week, it proved that the demand for socially responsible investments (SRI) extends to the riskiest of asset classes, meaning other banks are certain to bring out their own versions of the trade, writes David Freitas.

-

-

Following the sale of its third syndication of the year this week — a €3bn inflation-linked bond — France does not expect to bring any more public benchmarks in 2020.

-

Insurance companies saw a favourable window of opportunity this week to sell subordinated debt. Assicurazioni Generali, Crédit Agricole Assurances and CCR Re benefited from the supportive backdrop to raise tier two bonds.

-

Emerging market corporate bond supply grew on Thursday, with a strong showing from the Central and Eastern European region added to by Czech Gas Networks.

-

Philip Brown and Sanaa Mehra are leading a new unit at Citi, the latest the bank has designed for its sustainable finance business.

-

France hit screens with a 15 year inflation-linked bond on Wednesday, raising €3bn with its first syndicated linker since 2018, capitalising on growing demand for inflation-linked products.

-

Sodexo, the French food service and facilities management firm, saw bumper demand for its €1bn no-grow dual-tranche bond issue on Wednesday, a day after it reported a 30% drop in revenue, and weeks after it shocked the US private placement (PP) market by saying it would repay around $1.6bn of debt early as it could do better in other financing markets.

-

Central and Eastern European commercial real estate operator NEPI Rockcastle issued a green bond on Tuesday, attracting new investors to its debt.

-

International Container Terminal Services (ICTSI), a Philippine port company, made a quick return to the debt market on Tuesday, selling a $300m perpetual bond just weeks after securing a $400m trade.

-

BMW Automotive Finance bagged Rmb8bn ($1.14bn) from a three tranche auto loan ABS transaction on Tuesday. The deal was priced tightly despite difficult market conditions in China.