Central America

-

We need to broaden the definition of a greenium beyond new issue pricing metrics

-

Sovereign in ‘comfortable’ funding position as Samurai hits size target, says public credit head

-

Sovereign drops seven year and sees limited price tension but hits size target

-

-

The sovereign first presented the framework to Japanese investors in 2020

-

Pan-Latin America power company will spend up to $200m prepaying debt

-

Despite better markets, few expect issuance volumes to recover from lowest levels in years

-

Sovereign's bondholders preferred to keep longer dated bonds

-

Mexican leasing company stops debt payments amid funding squeeze

-

Sovereign uses SDG-linked bond framework in dollars for the first time

-

Other borrowers may have limited time to take advantage

-

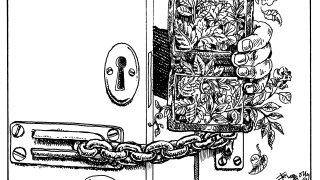

It's time for borrowers and bankers to shake off the summer lethargy