CEE Bonds

-

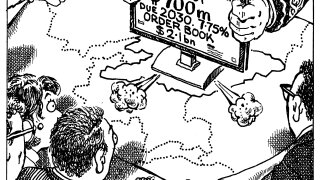

BEH offers rare chance to buy non-sovereign Bulgarian debt

-

International bond issuance will still be lower than many of the past few years

-

BEH will add to a busy period for state-owned issuance in CEEMEA

-

Slovenia had penned in an SLB debut for June

-

Estonian bank is paying no concession, thought one observer

-

The bank printed Estonia's first ever international AT1 in February

-

Pricing was tight after sovereign found healthy demand

-

◆ ABN eyed traffic jam ◆ NIBC competes with popular names ◆ Pekao manages book sensitivity

-

◆ Deal multiple times subscribed ◆ Fair value debated ◆ RCI Banque experiences attrition

-

The country is set to offer less than 100bp of spread over Uzbekistan

-

The Turkey sovereign trade was as well timed as ever, said observers

-

Another CEE trade from Hungary's development bank will also price on Wednesday