Belgian Sovereign

-

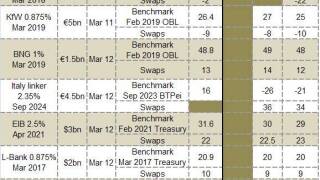

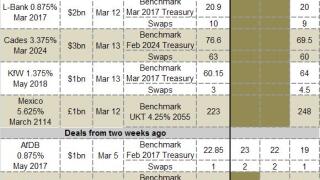

Read on to see how selected benchmarks are faring in secondary. Trading levels given are bid-side spreads versus mid-swaps and/or an underlying benchmark as of Thursday's close. The source for secondary trading levels is Interactive Data.

-

Brussels-Capital Region wants to raise €70m in private placements by April 8 but is receiving more inquiries for longer tenors than it wants to print. French regions could look to take advantage of the excess demand and print longer notes, according to medium term note dealers.

-

Read on to see how selected benchmarks are faring in secondary. Trading levels given are bid-side spreads versus mid-swaps and/or an underlying benchmark as of Thursday's close. The source for secondary trading levels is Interactive Data.

-

What do Mexico, Belgium and the government body responsible for handling London’s sprawling transportation network have in common? They all showed remarkable judgement and daring in their approach to funding over the past week.

-

A remarkable start to the year for the eurozone periphery is in clear view in this month's sovereign funding scorecard. Just two months into the year, Portugal has completed more than half of its target, while Ireland is not far behind. At the other end of the volume spectrum, Spain is making good headway in tackling its €133.3bn target with 26% completed, while Italy — which has yet to sell a syndication this year — is behind on 18%.

-

Read on to see how deals priced earlier in the year are faring in secondary. Trading levels given are bid-side spreads versus mid-swaps and/or an underlying benchmark as of Thursday's close. The source for secondary trading levels is Interactive Data.

-

Read on to see how benchmarks priced in the first three weeks of the year are performing in the secondary market. Trading levels given are the bid-side spreads versus mid-swaps and/or an underlying benchmark bond as of Thursday's close. The source for secondary trading levels is Interactive Data.

-

The rampant start to 2014 by peripheral eurozone sovereigns is clear to see in this week's funding scorecard, with the region's comeback kids Ireland and Portugal halfway and a quarter way through their funding programmes already. Spain has also made promising progress in its attempt to hit what is its largest ever funding target, with nearly a fifth of its total already in the bag. Italy will look to move into double figures from its 4% status in the coming weeks with a widely expected syndication.

-

Read on to see how deals priced in the first week and second weeks of the year are faring. Trading levels given are the bid-side spreads versus mid-swaps and/or an underlying benchmark bond as of Thursday's close. The source for secondary trading levels is Interactive Data.

-

The European Financial Stability Facility and the Province of Quebec mandated banks for new euro benchmarks on Tuesday, following in the footsteps of a highly successful 10 year deal from the Kingdom of Belgium. The Kingdom’s relatively high yields compared to other non-peripheral eurozone issuers helped to boost demand for the trade, according to bankers close to the deal.

-

Belgium has hired banks to run a long-dated syndication this week, it announced on Monday morning, while the EFSF is expected to pick a maturity between five and 10 years when it mandates for its first benchmark of the year later this week.

-

Cities and municipalities from Flanders are likely to follow the success of their first jointly guaranteed bond next year with further deals, according to syndicate bankers. The debut bond came a day before the Belgian sovereign announced its funding plans for 2014 on Tuesday.