Banks

-

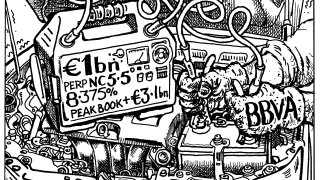

Spanish funder delivers both price and size as investors flock to shorter tranche

-

Tightest deal from LBBW struggled to reach full subscription as investors leaned towards spread

-

Blockchain platform protocol aims to reduce carbon footprint of participants

-

-

The move reinforces the UK bank's effort to strengthen its corporate and investment bank in EMEA

-

Pipeline includes LBBW's dual tranche that will also feature a 10 year maturity

-

Demand for high yielding paper drives comeback for most subordinated bank capital

-

Italian lender pushes out to print 31 year non-call 30 note

-

The recent acquisitions of Numis and Greenhill are just the beginning, say bankers, as rising costs and slumping revenues test the business models of independent and medium-sized investment banks

-

French corporate ends 11 year absence to land 5bp-10bp inside of euros

-

◆ Opco bond choice counteracts wild swings in rates ◆ 'Rrisky strategy' but issuer tightens pricing ◆ Spread buyers lock on to high yield

-

Deutsche Bank has overhauled its global financial institutions group with three hires, including Credit Suisse’s top FIG banker in Europe.