Awards

-

Citigroup The firm has moved up the ranks in equity derivatives globally, partly as a result of senior level hires over the last 12 months who’ve brought more complex derivative product knowledge to the business. One noteworthy development has been its innovation in providing products and services to investors which allow them to take advantage of the arbitrage between the roll of the VXX and the VIX. Simon Yates in the U.S., Rachel Lord in Europe and P.J. Andersson in Asia, head up equity derivatives in their respective regions. Notable hires over the last 12 months include Frederic Valmorin and Rory Hill in equity derivatives trading in London, and Brennan Warble as head of equity sales trading in New York.

-

Barclays Capital Barclays Capital’s credit derivative business was cited by investors as a constant provider of liquidity in the market and as one of the market share giants. Led by Eric Felder, head of global credit trading, the dealer has stood out for leading innovation in the credit derivatives market. BarCap was the first dealer to clear an over-the-counter credit derivative for a European asset manager, Robeco. The firm also began making markets on General Motors credit default swaps, despite the fact there were no outstanding GM bonds to reference after the company emerged from bankruptcy. In December, the firm began sending out initial price runs on the CDS, which quickly became a liquid two-way market.

-

The editors of Derivatives Week/Derivatives Intelligence have selected 42 nominees across nine categories for its 2011 Global Derivatives Awards.

-

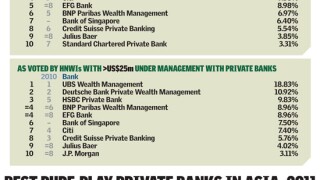

The extended results from Asiamoney's 2011 Private Banking Poll, including category results for each country in the region.

-

The overall result for ASIAMONEY's 2011 Private Banking Poll.

-

Each year we reveal which domestic banks, equity brokerages and debt houses stand out for excellent performance. In Taiwan Fubon Financial cuts costs while expanding into insurance and China. Meanwhile Yuanta's execution excels in equity but it loses to KGI in debt.

-

Each year we reveal which domestic banks, equity brokerages and debt houses stand out for excellent performance. In Australia National Australia Bank turns its business around, Macquarie soundly beats its equity rivals, and ANZ helps the most other companies do bonds.

-

Each year we reveal which domestic banks, equity brokerages and debt houses stand out for excellent performance. In Japan MUFG just beats out its megabank rivals for profitability and international growth, Nomura dominates equity markets and Mizuho stands tall in debt.

-

Each year we reveal which domestic banks, equity brokerages and debt houses stand out for excellent performance. In Thailand Kasikornbank's savvy lending ensures that it stands out. Its debt capabilities also shine, while Phatra Securities leads the way for equities.

-

Each year we reveal which domestic banks, equity brokerages and debt houses stand out for excellent performance. In Vietnam Asia Commercial Bank continues to stand out for its superior operations, profitability, and increase in consumer banking activity.

-

Each year we reveal which domestic banks, equity brokerages and debt houses stand out for excellent performance. In Singapore OCBC’s expansion strategy and strong deposit base net it the award for top bank, while DBS benefits from its strength in equity and debt.

-

Each year we reveal which domestic banks, equity brokerages and debt houses stand out for excellent performance. In Indonesia Bank Mandiri shines for overall capital strength, profitability and diversification, and along with its securities arm excels in equity and debt.