Austria

-

Investors were eager to buy Vorarlberger Landes-Und Hypothekenbank’s mortgage-backed Pfandbrief on Wednesday. The deal’s success suggests few were worried about the issuer’s Swiss franc exposure, possibly because the income of many obligors is also in Swiss francs.

-

Vorarlberger Landes-Und Hypothekenbank (Vorhyp) has mandated leads for a sub benchmark sized mortgage Pfandbrief.

-

Erste Bank’s first covered bond in three years issued on Thursday was nearly three times subscribed in less than an hour. The rollicking result showed it was unaffected by mounting concerns in the Austrian bank sector generally, and over its peer Raiffeisen Bank in particular.

-

Wienerberger, the world’s largest brick maker, has replaced two lines of credit with a €400m five year revolver.

-

It is a truth universally acknowledged that the important parts of any financial conference typically take place off the stage rather than on it.

-

Austrian lender Hypo Tyrol issued its first publicly distributed deal on Wednesday, pricing a sub benchmark sized €300m public sector Pfandbrief. The transaction’s smaller than usual size meant it was not eligible for the covered bond indices, which deterred large investors. However, investors were compensated for the less liquid size with a wider than usual spread.

-

Hypo Tirol has mandated leads to roadshow its inaugural syndicated €300m public sector backed Pfandbrief starting this week.

-

Hypo Noe priced its inaugural €500m Austrian mortgage-backed Pfandbrief on Monday through the bid side of its interpolated public sector curve, and with barely any sensitivity in the book. The strong result is a testimony to the enhanced demand for all covered bonds that offer a spread over mid-swaps and anything that is potentially eligible for the forthcoming European central bank purchase programme.

-

Hypo Noe has mandated leads for its inaugural mortgage backed Pfandbrief, to be launched next week.

-

The covered bond market passed another milestone this week with core transactions attracting book sizes that were reminiscent of the yieldy peripheral deals seen a year ago, but at spreads well through swaps. With supply likely to slow after September, the European Central Bank ready to absorb a large portion of whatever is subsequently issued and sovereign yields expected to head further into negative territory, the technical squeeze will become much tighter.

-

The Australian market for covered bonds has seen the fastest growth of any jurisdiction over recent years, said Deutsche Bank’s research team on Thursday. This extraordinary growth may reflect the regional banking system's dependency on wholesale funding. But Moody’s was constructive on the covered bond market in a report published on Wednesday, and with bonds likely to become eligible for European bank liquidity buffers, spreads are expected to tighten.

-

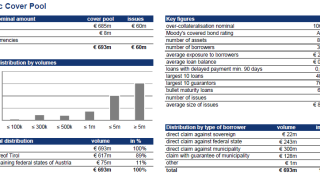

UniCredit Bank Austria (UBA) has tripled the share of non-profit housing loans in its mortgage pool in a year and reduced the share of riskier commercial mortgages, in a move which Moody’s said was credit positive for its Aa1 programme.