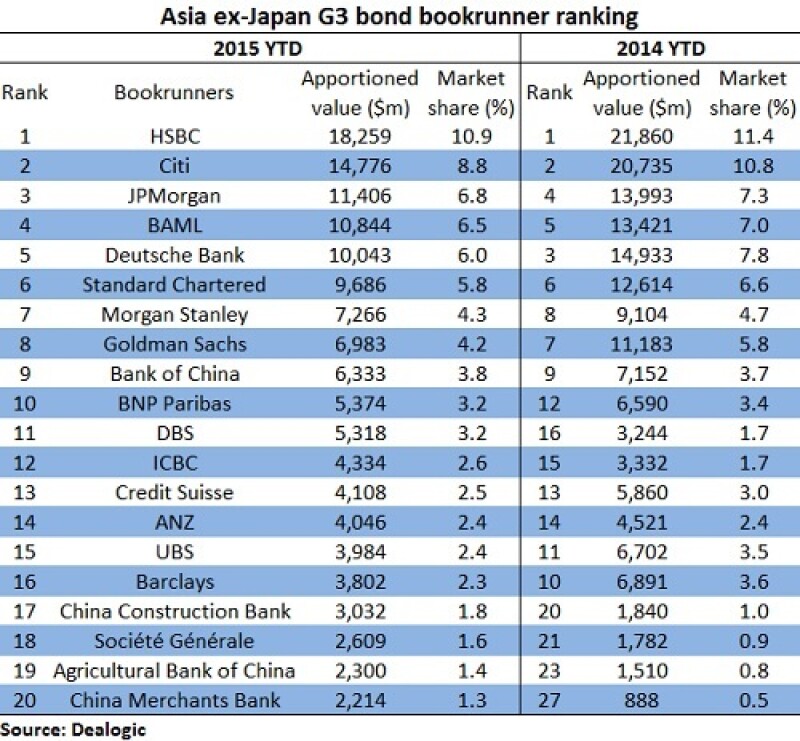

With the Asia ex-Japan primary bond market set to wind down in the coming two weeks, there is likely to be little change to the G3 DCM league table. On the surface, not a lot has changed, with global firms hovering at the top. But comparing it with the same data from last year, something interesting appears (see graph).

Twelve banks among the top 20 in the bookrunner league table have seen their market share drop this year – all of them international banks. And of the remaining eight, five are Chinese — Agricultural Bank of China, Bank of China, China Merchants Bank, China Construction Bank and ICBC— and all have increased their share.

There are a couple of reasons for their outperformance. One is the simple fact that China is by far the largest issuing country in the region. This means that Chinese banks with their onshore relationships find it a tad easier to get on transactions than their international counterparts.

There is also a second and more contentious reason – that banks use their balance sheet to get onto deals, and as one Hong Kong-based head of DCM put it, give companies a loan disguised as a bond.

This trend has been particularly noticeable on CNH and euro-denominated trades with their preponderance of anchor orders, which critics say distorts pricing as there is guaranteed demand from Chinese bank treasuries.

But it’s time the market realises that Chinese lenders know what they are doing. After all, the end objective is to help companies achieve their fundraising targets. And enlisting the help of their bank treasuries is just an effective way to do that.

For starters, Chinese firms don’t have a long history of executing deals and certainly don’t have experience in markets outside of Asia to fall back on. What they are doing now is simply how they’ve always worked in the onshore bond market.

And since they are relatively new to the game, their top priority is to quickly establish a strong presence and build their brand. If that means using a bit of their balance sheet to win a seat on deals, so be it.

This is especially true as the one thing the Chinese don’t lack right now is cash. A Chinese brokerage recently told GlobalCapital Asia that it had a HK$80bn ($10bn) balance sheet, which it was happy to use for its corporate finance business.

Chinese banks are quite simply playing to their own strengths and not trying to compete with their better established peers on execution and structuring. And considering how crowded the Asian bond market is, it’s only natural that they’re relying on their biggest asset. After all, it’s the same game the international banks played before their capital ratios came under intense scrutiny during the financial crisis.

Of course, this type of lavish spending can’t continue forever especially as the big four banks — Agricultural Bank of China, Bank of China, China Construction Bank and ICBC — will soon need to comply with higher capital requirements because of their status as global systemically important banks (G-Sibs). Coincidentally, these are also the four highest ranked Chinese debt houses in the bookrunning league table.

But that is still many years down the road. The hope is that their execution and structuring will have improved enough by then to compete with global peers on an equal footing once they have taken on board the Financial Stability Board’s more stringent total loss absorbing capacity (TLAC) requirements.

That is only going to phase in in 2025 for China. Until then critics will have to continue watching Chinese banks move up the league table.