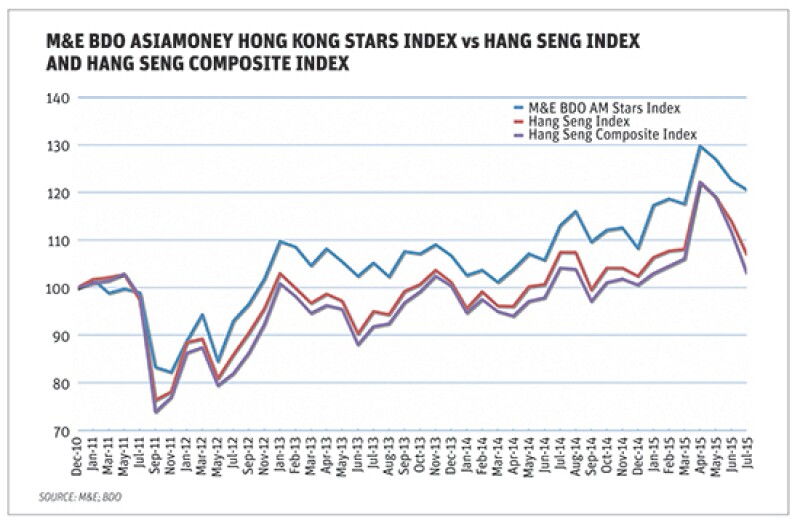

The Hang Seng indices have almost fallen to December 2010 levels, but the M&E BDO Asiamoney Hong Kong Stars Index is more than 20% above where it started in December 2010. In fact, between June and July 2015, the Stars Index only lost two percentage points. Why?

The explanation is that the M&E Stars Index method quantifies the management quality of an Index component and weights it accordingly. Well managed companies are relatively higher weighted in the Index. And rational investors are less likely to discard quality equity, even in down times.

Well-run companies are more transparent and put more into investor relations than their less well-run counterparts. They have more good news to report on, and better financials. Investors, in turn, can make more well-founded decisions and will also appreciate these companies' resilience in crashes.

The accompanying chart comparing the M&E Stars Index with its Hang Seng benchmarks clearly reveals a less steep downward curve. Yet the M&E Stars Index includes only 22 components, which should in theory make it more volatile than indices with more components. Most financial specialists preach that a larger number of components reduces idiosyncratic risk.

Moreover, the chart also shows that the Stars Index has never looked back once it began significantly outperforming its benchmarks. "Typically, indices outperform and underperform each other over longer periods of time," says Patrick Rozario, partner at BDO, which conducts the research for the Stars Index in Hong Kong.

Looking into the Stars Index's numbers, the reasons for the Index's resilience become clearer. Its heavyweight, China Mobile (35.7% weighting), actually grew its market cap, while AIA (11%) hardly dropped in the same period. Other insurance companies in the Index, including Manulife and Prudential remained equally stable.

.

Dr William Cox is CEO of Management & Excellence (M&E), which is partnered with BDO Financial for Hong Kong & Asia. M&E/BDO Hong Kong specialise in calculating and raising the ROI of governance and other management processes.