Loans to finance such transactions have typically been in rupees, but the $220m facility recently raised by global asset manager Brookfield Strategic Real Estate Partners (BSREP) for an acquisition of office space in India is an unusual instance of a US dollar syndication for this purpose.

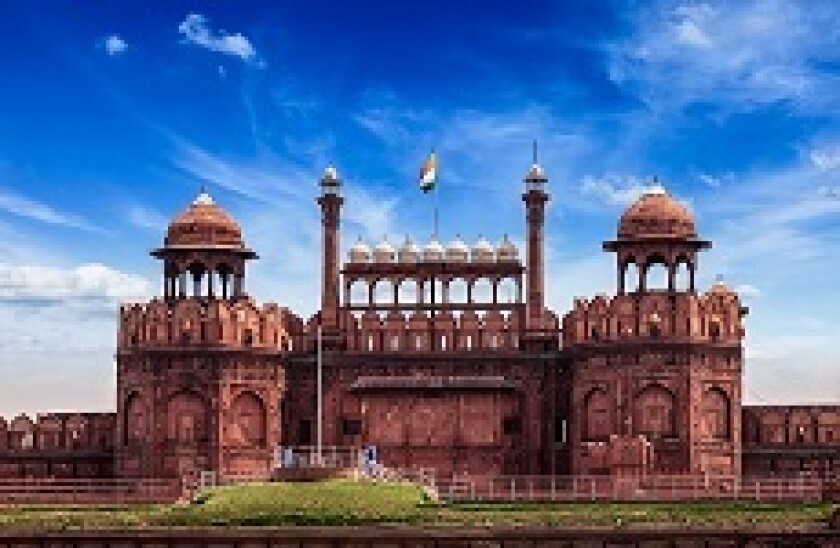

Investor confidence in India has been buoyant ever since prime minister Narendra Modi came into power over a year ago. One outcome of that has been an increase in real estate related acquisitions by global funds operating in India.

“Now, macroeconomic conditions have made it impossible for a number of large international investors to ignore India’s development opportunity any longer,” wrote Ernst & Young analysts in a recent report detailing private equity trends in real estate. “A few are stepping back into the market, albeit with new, less risky ways of investing,”

These transactions can be funded by a combination of structured debt, structured equity and mezzanine financing, said E&Y. “[Indian real estate] deals involving high-cost, structured finance have been most active, given the number of stalled projects from the last cycle that are looking for financing to restart.”

The BRSEP trade, which two sources said was funded by Deutsche Bank, HSBC and Standard Chartered earlier this year, is one deal that has emerged from this trend. GlobalCapital Asia understands that these banks are now distributing the loan among a limited group of investors, including other banks as well as funds.

“This US dollar loan is a one-off [at the moment], although we have seen similar activity on the rupee side,” said a third source. “There was a [rupee] loan done for Blackstone in 2014 when they acquired property in Pune and Bangalore.”

And it may remain an outlier, since as with all acquisition funding there are plenty of factors very specific to the individual trade that need to align for a deal to work: a suitable target, an acceptable valuation for all parties and the availability of the right financing. That makes it hard to predict whether there will be any surge in such loans, said the second source.

“In real estate [loans], leveraging is an issue,” said a Singapore-based banker away from the Brookfield trade. “And as with real estate anywhere, it depends on where the valuations are, where the property is and in some ways, betting on real estate in India is like betting on its growth, which is yet to come.”

But distribution can at least be broader than in some transactions. "Property deals can be looked at by insurance companies and as an asset class it appeals to non-bank institutions also," said the first source. "So it can be distributed among them, not just bank investors.”

Risk protection

To conform to Indian regulations, syndicated loan funding for property related acquisitions must be raised by a holding company, and this is the case with the Brookfield loan. To compensate lenders for the risk of lending at the holdco level, the loan is offering a margin of 625bp for the first 12 months, which steps up to 675bp.

The Brookfield deal offers banks protection in the form of recourse to shares of the borrower. There is also understood to be a loan-to-value related covenant. The borrowing entity is BSREP India Office Holdings.

The three leads sent out invitations for the loan on May 28, according to a banker not involved in the transaction.

Those interested can choose from three levels. Mandated lead arrangers committing a minimum of $40m earn 150bp fees, lead arrangers committing from $25m to less than $40m earn 125bp and arrangers committing from $10m to less than $25m earn 100bp.

The last date for the submission of commitments is June 26.

Brookfield is a global alternative asset manager, founded more than 100 years ago. It focuses on assets in property, renewable energy, infrastructure and private equity.

In November 2014, it acquired a 60% interest in Candor Office Parks, a 15m square foot portfolio of office space in India. It acquired the remaining 40% equity interest in March, it said in a report posted on its website.

It had $207bn of assets under management as of March 31. The company's consolidated net income during the first three months of the year grew 70.6% from the same period last year, to $1.44bn, according to its most recent results announcement.