Asia Pacific

-

◆ Flow picking up in quiet sterling market ◆ CMA's redetermination unlikely to change credit metrics for UK water companies ◆ Logistics real estate issuer kicks off euro green bond

-

The state-owned issuer printed flat to its curve, said a lead

-

Oversubscribed loan adds $800m of liquidity

-

◆ Deal first in sterling from Australia since late 2024 ◆ Trade prices flat to euros ◆ October redemptions could drive further supply

-

The bank might not issue again for a while, but more Uzbek issuers are preparing trades

-

◆ South Korean lender enters sterling for the first time ◆ Spread move the biggest in 18 months ◆ Deal lands flat to fair value and euros

-

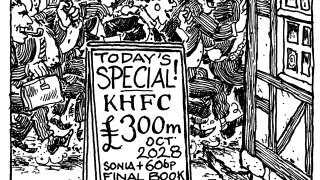

◆ No premium needed for 'well-funded' name ◆ Final book the biggest in four weeks ◆ Deal attracts strong asset manager bid

-

◆ QNB deal to pique Gulf interest in euro issuance ◆ Denmark develops green market with EuGB ◆ Foreign AT1s return to Aussie market

-

Deal opens door for more foreign FIG regulatory capital raising Down Under

-

◆ Italian public development bank 'pricing like a credit' ◆ Investors drawn to three components ◆ MuniFin and New Zealand Local Government priced in dollars

-

◆ Maybank gathers sticky, high quality demand ◆ No premium needed ◆ Prima prices tight

-

◆ Post-Seville conference pipeline builds ◆ Traffic jam possible but ample liquidity is there ◆ Kookmin takes €600m at four years