Asia Pacific

-

One bondholder said he was confident others would accept terms of consent solicitation launched on Tuesday

-

Masters took the helm of fintech in August this year

-

Upcoming deal will extend the Australian lender’s secured curve

-

London's airport is the third foreign corporate to tap the Swiss market this week

-

Three issuers hit the market on Thursday, as pipeline builds for next week

-

Development is considered largest landmark hospital project in the country

-

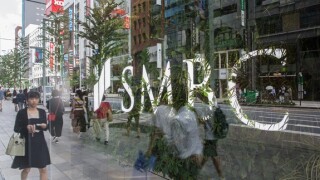

Japanese bank goes ahead of peers by merging bank and securities firm in EMEA

-

◆ First KDB public sterling deal in seven years ◆ £250m bond could be first of many as issuer diversifies ◆ SSA transition ongoing, euros in focus for 2025

-

-

Local currency tranches may become more common

-

Investors feasted on the first international bond from the global mining giant

-