Asean

-

Philippine lender BDO Unibank issued its first dollar bond in four years on Monday, amid a busy day of primary issuance in Asia ex-Japan.

-

Julius Baer made a successful comeback to the Singapore dollar market on October 13, shrugging off concerns around the downgrade of its existing subordinated notes to raise S$325m ($235m) from an additional tier one.

-

MMI International has picked four banks to arrange its new 144A/Reg S deal, and is set to meet investors from next week.

-

JP Morgan is looking to sell its stake in its China joint venture with First Capital Securities, which began operations in 2011.

-

ZTO Express and Samsung BioLogics are seeing bumper responses for their jumbo IPOs in the US and South Korea respectively, as bankers expect their bookbuilds to gain even more momentum.

-

A five year loan for a subsidiary of Employees Provident Fund of Malaysia has entered syndication, three months after the leads were chosen.

-

Malaysia’s CIMB Group and China Galaxy Securities Co said they are in talks to form a 50:50 joint venture for their stockbroking operations.

-

GlobalMarkets: Vietcombank’s stated ambition is to establish itself as the number one bank in Vietnam and one of the top 300 in the world. Very briefly, can you explain how Vietcombank will achieve this ambition?

-

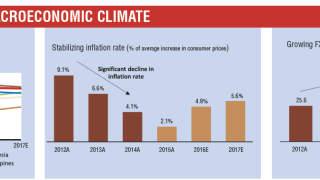

Vietnam is one of the fastest growing economies in the emerging market universe, and an increasingly popular magnet for investors looking to establish a hub in the ASEAN region. But explosive growth is creating a number of challenges.

-

Philippine lender BDO Unibank issued its first dollar bond in four years on Monday, but found itself competing for investors' attention on a busy day of primary issuance.

-

Syndication is under way for a A$500m ($380m) five year facility to support Philippine consumer food and beverage company Universal Robina Corp’s acquisition of Snack Brands Australia.

-

Keppel DC Reit Management has kicked open a rights issue worth up to S$279.5m ($201.4m), while Zhuguang Holdings Group Co has launched a HK$1.4bn ($180.4m) offering — both to fund acquisitions.