Asean

-

Indonesia’s triple-C rated Indika Energy grabbed $265m from a new deal on Monday, on the back of a five times subscribed book fueled by yield hungry investors.

-

Ascott Residence Trust has wrapped up its rights issue 1.8x covered, raising S$442.7m ($313.7m) for the Singapore real estate investment trust.

-

South Korea’s Lotte Group is targeting a third quarter listing of its Malaysian petrochemicals arm, which will raise more than $1bn.

-

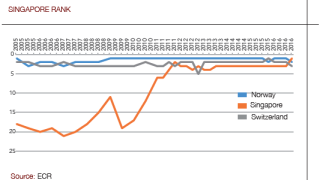

The nation state is the safest in the world, according to Euromoney Country Risk, but its neighbour Malaysia is heading in the opposite direction. And, at last, it looks like it is India’s time to shine

-

Stressed situation in oil and gas exposures weigh on annual results, but CEOs hope to see a wealth management upside

-

A year after the country’s new government passed a financial institutions law to modernize a creaking banking system, Yangon’s licensed commercial bankers are still waiting for regulators to implement the reforms and make the system fit for purpose. In the meantime, savvy locals are trying to get on with building a banking industry

-

Myanmar’s elite are having to adapt to new realities. For Htoo Htet Tay Za, head of AGD Bank, that means trying to create a modern bank in a backward financial system while battling allegations of cronyism levelled against his family

-

Indonesia’s Modernland Realty is preparing for a new US dollar bond this week, following compatriot property issuer Pakuwon Jati’s tightly priced February deal.

-

Sumitomo Mitsui Banking Corp has beefed up its loans distribution team for Asia, in line with its objective to build its capabilities in the business.

-

Indonesia Eximbank and State Bank of India each secured $500m bonds on Thursday, offering investors some alternative to the Greater Chinese names that blasted into the market.

-

Singapore-based Fullerton Healthcare sealed an inaugural dollar-denominated perpetual from a company in the healthcare sector in Asia, bagging a larger-than-expected $175m from its first dollar outing on Thursday.