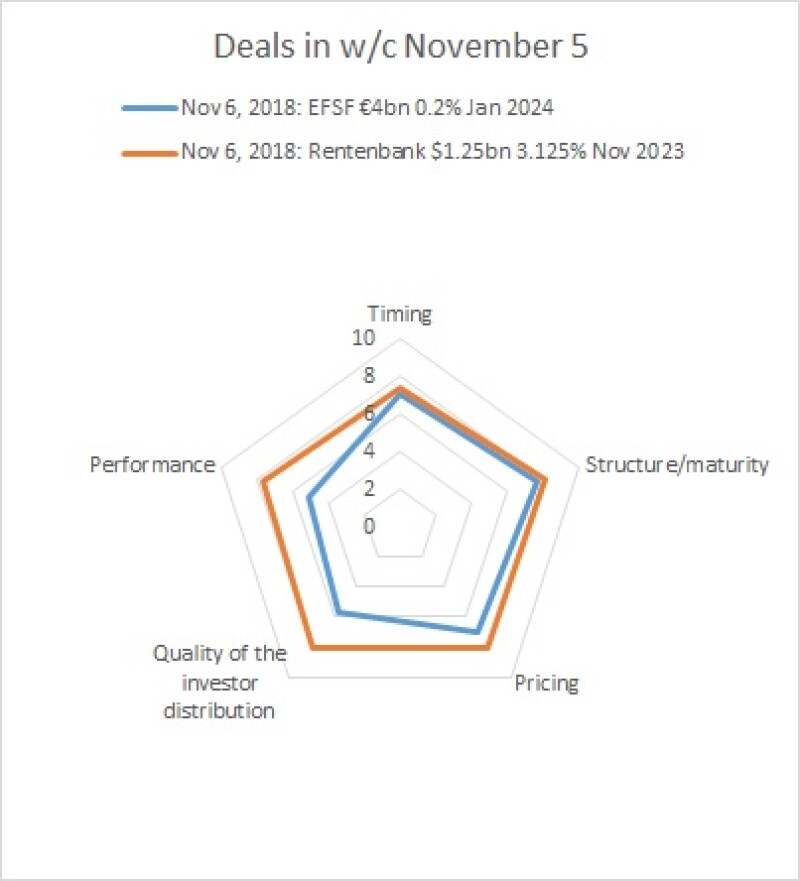

Rentenbank’s $1.25bn November 2023, priced on November 6, scored an overall average of 7.83, with voters particularly impressed in the structure/maturity category, which took 8.17.

“It feels like investors are less worried about a steepening of the curve and are more expecting a flattening, so that means they’re interested in a five year as opposed to a short end trade,” said an on-looking SSA banker at the time.

The deal’s lowest score came in the timing category, although it still took a decent 7.33.

“I was slightly surprised they brought their sole dollar benchmark of the year this week [commencing November 5] given it’s the mid-terms and there’s a Federal Open Market Committee meeting, but it didn’t seem to make a blind bit of difference,” said a second on-looking banker at the time.

Rentenbank’s high score is in keeping with a dollar market that has been resilient in the face of potential headwinds.

By contrast, several factors — from the end of eurozone quantitative easing to the fallout between Italy and the European Commission over the former’s budget plans — have led to tricky conditions and spread widening in euros.

That took its toll on the BondMarker score for EFSF’s €4bn January 2024, also priced on November 6, which took a low rating of 5.17 for performance and 5.67 for quality of the investor book. That helped drag down the overall average to 6.50.

“EFSF’s deal was fine and had a decent book, it just shows that the euro market is a bit weaker — a couple of months ago EFSF would have got a €10bn book with this,” said an on-looking SSA banker at the time of pricing. The deal took orders of nearly €6bn.